CARD MRI RIZAL BANK, Inc. encourages its members to develop a habit of saving. We developed different types of savings products to ensure that the needs of every member are met and satisfied.

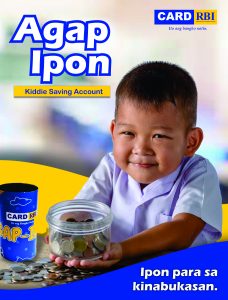

This account represents deposit account for kids that is specially designed for children to enable them in building a savings habit at an early state. It will enable child to save and become members of Kiddie Savers Club. Minimum initial deposit amounts to Php100.00 and maintaining balance is Php100.00. Minimum balance to earn interest is Php2,000.00 with 1% interest rate per annum.

*updated as of February 29, 2024

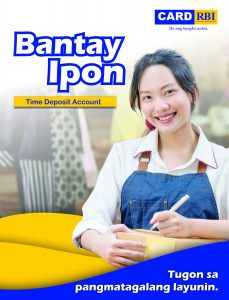

This account represents special savings account (time deposit) which helps the client to secure savings for a better future. Interest rate depends on the amount of deposit and term. Minimum initial deposit amounts to Php10,000.00 and maintaining balance is Php10,000.00 with 3.25% to 4.95% interest rate.

*updated as of June 16, 2025

This account represents regular savings account evidenced by passbook. Minimum initial deposit amounts to Php200.00 and maintaining balance is Php100.00. Minimum balance to earn interest is Php2,000.00 with 1% interest rate per annum.

This account represents regular savings account evidenced by passbook. Minimum initial deposit amounts to Php200.00 and maintaining balance is Php100.00. Minimum balance to earn interest is Php2,000.00 with 1% interest rate per annum.

*updated as of January 31, 2024

This savings product is offered to further honor and value Senior Citizens by enabling them to

This savings product is offered to further honor and value Senior Citizens by enabling them to

accumulate necessary funds to open a Gabay-Ipon account, while also yielding higher returns on their hard-earned money. This account represents regular savings account evidenced by passbook. Minimum initial deposit amounts of Php200.00. Minimum balance to earn interest is Php2,000.00 with 2% interest rate per annum.

This account represents each member's capital build-up and also acts as loan guarantee given that loans are non-collateralized. It consists of the P50 weekly Pangakong-Ipon. The primary purpose of the Pangakong-Ipon is to have a capital build-up fund which members can use for buying shares of stocks from CARD MRI Rizal Bank, Inc. as well as to serve as guarantee for their loans. Minimum initial deposit amounts to Php50.00 and maintaining balance is Php100.00. Minimum balance to earn interest is Php2,000.00 with 2.50% interest rate per annum.

This account represents each member's capital build-up and also acts as loan guarantee given that loans are non-collateralized. It consists of the P50 weekly Pangakong-Ipon. The primary purpose of the Pangakong-Ipon is to have a capital build-up fund which members can use for buying shares of stocks from CARD MRI Rizal Bank, Inc. as well as to serve as guarantee for their loans. Minimum initial deposit amounts to Php50.00 and maintaining balance is Php100.00. Minimum balance to earn interest is Php2,000.00 with 2.50% interest rate per annum.

*updated as of February 29, 2024

It is a deposit account with check book facility. It is also known as current or demand account. Typically, this is used for making business payments (currently available only in Sta Cruz- Head Office). Minimum initial deposit and maintaining balance of Php5,000 (non-interest bearing) or Php50,000 (interest bearing) with 1% interest rate per annum and is evidenced by check booklet.

*Effective December 1, 2023

CARD MRI Rizal Bank, Inc. recognize the importance of financial security and peace of mind, especially during your retirement years. We are delighted to introduce our Senior Citizens Term Deposit Account, Gabay Ipon is crafted for your specific needs to provide stability, growth, and reliable returns.

CARD MRI Rizal Bank, Inc. recognize the importance of financial security and peace of mind, especially during your retirement years. We are delighted to introduce our Senior Citizens Term Deposit Account, Gabay Ipon is crafted for your specific needs to provide stability, growth, and reliable returns.

-Open to clients (Member and Non-Member) 60 years old and above

-With maturity terms of 35, 65, 95, 185 and 365 days

-Minimum initial deposit of P10,000

-Maintaining balance is P10,000

-With 3.50% to 5.20% interest rate per annum, depending on the amount of deposit and terms

-High Interest rates

*Effective June 16, 2025

This product is intended for the bank’s members with the aim of further promoting the bank’s savings mobilization program. It is a recurring deposit account with a fixed deposit amount every week with a pre-determined target total savings amount after a definite period. Interest rate depends on the desired target savings and term. Minimum balance to earn interest is Php1,000.00 and is supported by a signed agreement/contract.

**Currently available at Sta. Cruz Head Office only.

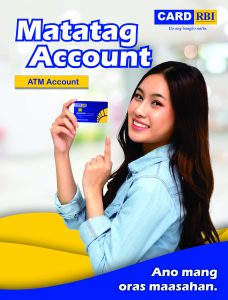

Matatag account represents a savings account that provides the option for regular savings with easy access to withdraw 24x7 through the automated teller machine (ATM). The minimum initial deposit amounts to Php100.00, and the minimum balance to earn interest is Php2,000.00 with a 0.5% interest rate per annum.

Matatag account represents a savings account that provides the option for regular savings with easy access to withdraw 24x7 through the automated teller machine (ATM). The minimum initial deposit amounts to Php100.00, and the minimum balance to earn interest is Php2,000.00 with a 0.5% interest rate per annum.

*updated as of February 29, 2024

Tagumpay savings, is a term savings that seeks to encourage savers to deposit regularly in order to achieve or fulfill a dream such as building a house for their family, higher education for themselves or for their children, etc. This account is a recurring deposit savings account with fixed deposit amount every week/month until it reaches the maximum term of 5 years. This shall be supported by a signed agreement/contract. Minimum initial deposit amounts to Php200.00 (for staffs) and Php100.00 (for members), minimum balance to earn interest is Php3,000.00 with 5% interest rate at the end of the term.

*updated as of January 31, 2024